Date£º

2015-04-14 15:26 Source£º

harpers.co.uk Author:

Erin Smith Translator:

China has reported a 15% fall in exports and a 12% fall in imports for the month of March 2015, which has increased concerns that the Chinese economy is slowing down.

The numbers, released today, compare March's trade figures with those from the same period a year ago. It follows the news that China lowered its growth target to 7% for 2015 last month. The new target was lower than that for 2014, which was targeted to grow at 7.5%.

China missed the 2014 target and expanded by 7.4%, the slowest pace of growth China's economy has seen in over two decades.

This may be a growing concern for the wine trade as many wine companies have increasingly focused on the expanding market.

According to a report Vinexpo commissioned early this year, which was compiled by International Wine and Spirits Research (IWSR), wine consumption in China is forecast to rise nearly 25% by 2018.

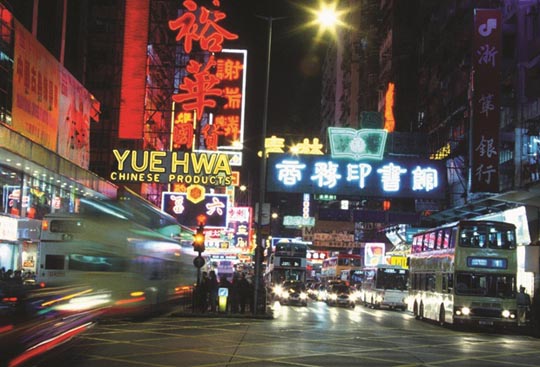

The Chinese market, including Hong Kong, accounted for nearly 145m 9-litre cases and is expected to rise to 181m cases by 2018.

With the slower than expected trading figures coming out of China today, the drop in imports could signal a decrease in consumer demand within the market.

Notably, however, some analysts cautioned that the decline in imports could be related to the decline in value of commodities such as oil and iron, which have in turn brought down import values.

According to IWSR figures for the first time in 10 years, wine consumption decreased slightly in 2013 down 2.5% compared to 2012.

This decline may be related to the Chinese government's crackdown of luxury gift giving that came into effect in 2013 and has had lingering effects on several premium wine and spirits brands that were over-exposed to the Chinese market. The ultra-premium cognac market in particular was hit hard.

Red wine producers seem to have the advantage of breaking into the Chinese wine market over white wine producers, as the Chinese market saw 136% increase in consumption of red in the five year period between 2008 and 2013, according to IWSR figures.

The recent challenges to the Euro compared to the strengthening Chinese Yuan Renminbi (CNY), has meant European wines have become increasingly less expensive to Chinese consumers.

In March the CNY hit its stongest rate with CNY ¥6.56:€1 (xe.com), which is up just over 30% from a year ago. This makes European wines significantly cheaper to the Chinese market.